UK mobile finance market doubles in 2011

Thursday, May 19, 2011 | 3:21 PM

Labels: Business strategy, Insights, Mobile, UK Finance Blog

One in ten UK consumers now use ‘mobile wallet’ whilst one in five use mobile banking

| Subscribe to this blog |

| Visit this group |

Thursday, May 19, 2011 | 3:21 PM

Labels: Business strategy, Insights, Mobile, UK Finance Blog

0 comments | | Email Post

Tuesday, April 19, 2011 | 4:00 PM

Labels: Insights, Mortgages, UK Finance Blog

0 comments | | Email Post

Monday, March 14, 2011 | 6:09 PM

Labels: Business strategy, Events, Mobile, UK Finance Blog

0 comments | | Email Post

Wednesday, January 5, 2011 | 10:29 AM

Labels: Ad Formats, Branding, Home Insurance, UK Finance Blog, Video, YouTube

Take a look at the YouTube UK Homepage today, for More Th>n's 'More Than Freeman' campaign - proof that you can make a splash with insurance!

0 comments | | Email Post

Tuesday, December 21, 2010 | 9:21 AM

Labels: Insights, Seasonality, Travel Insurance, UK Finance Blog

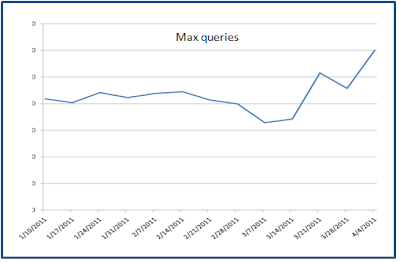

As the snow continues to disrupt travel plans across the UK and beyond, we've seen a peak in travel insurance queries. Travellers concerned for the impact of cancelled flights, missed connections and other disrupted travel plans may find themselves in the market for last-minute travel insurance.

Our advice?

0 comments | | Email Post

Monday, December 20, 2010 | 4:12 PM

Labels: Insights, Savings, Seasonality, UK Finance Blog

Searches around savings pick up immediately after Christmas as people resolve to save more for next year after the expensive festive season. Spotting and having the flexibility to act on this trend can help you cash in on consumer desire to save money.

The two week period between Christmas and the first week back at work represents the best possible time to build cost efficient market share in the Savings market.

While Queries see a huge jump in this window, CPCs move in the opposite direction (32% down in 2009) as advertisers tend to overestimate the reduction in demand over December and misalign budgets during this seasonal spike.

Our recommendations?

READ MORE from the Google Finance Team on how to make the most of the Savings market this Christmas .

0 comments | | Email Post

Friday, December 10, 2010 | 4:59 PM

Labels: Ad Formats, Branding, UK Finance Blog, YouTube

Today, a great example of a UK financial services company using the YouTube homepage takeover masthead ad format to gain brand visibility. Visa are running a 'Pay with Visa' competition and driving traffic to their own competition site through the YouTube masthead.

0 comments | | Email Post

©2010 Google - Privacy Policy - Terms of Service